Over trading and trading with emotions on CFD Trader will get you in trouble every time. Don't get too greedy when you're on a winning streak. Don't try to get revenge after losing an important trade. Use strategies based on clear thinking or the result will cost you money.

When you begin your CFD Trader trading experience, it is important to choose and account type that fits your trading goals and needs. Choosing the right account can be confusing, but a good rule to go by is that a lower leverage is good. Standard accounts are usually good to start off on if you are new to trading.

If you are going to enter the world of CFD Trader trading, it is important that you understand the world of money management. Taking control of your money is about making sure your losses are small and your gains are big. Once you start making a profit, do not throw your money around recklessly.

Don't be tempted to trade in the foreign exchange my review here market on impulse. Have a plan and stick to it. Impulsive trading will most likely only lead to losses. If you stick to your plan, you can limit your risk and your losses, and be there to jump on the profitable trades when they come along.

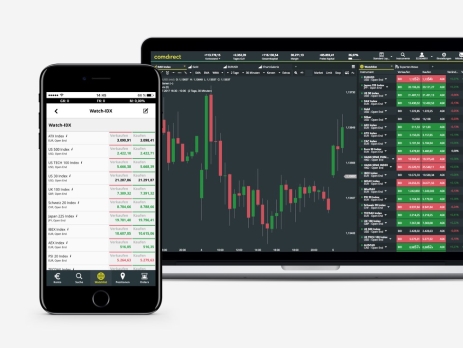

When trading, do yourself a favor and keep your charts clean and easy to read and understand so that you can effectively use them. Some people have incredibly cluttered charts for reference and if you're a novice, you will think that they know what they're talking about. Most of the time that is not the case. So keep yours clear of clutter so that you can effectively see what's going on in the markets.

Don't stop using your demo CFD Trader account just because you open an account that uses real money. Learning about the CFD Trader markets doesn't stop when you start trading. You can use your demo account to test various configurations of your trading plan, such as to see if you may be too conservative with your stop loss markets.

One thing every CFD Trader trader should understand is the importance of setting up goals. Determine exactly what it is you are trying to achieve from trading. With specific predefined goals set up, it is much easier to come up with a strategy that will allow you to successfully reach your goals.

To find the perfect moment to invest, pay attention to both the spot rate and the forward rate. The forward rate indicates the given value of a currency at a certain point of time, regardless of its spot rate. The spot rate indicates the current fluctuation and allows you to guess the upcoming trend.

Armed with this knowledge you are now ready to enter the currency trading market. Bear in mind that, as with any other new venture, the key is to start out slowly and steadily. Never trade more than you can afford to lose and continue to source new information and tips as your trading expertise grows.